Let’s be honest. When you’re building a startup from the ground up, credit management is probably the last thing on your mind. You’re focused on product, customers, and that ever-elusive product-market fit. But here’s the deal: how you handle credit early on can be the quiet engine of your growth—or the hidden anchor that drags you down.

For bootstrapped and self-funded entrepreneurs, every dollar is a soldier in your army. Credit isn’t just a safety net; it’s a strategic tool. But it’s a double-edged sword. This isn’t about complex corporate finance. It’s about practical, actionable steps to build a financial foundation that supports your hustle.

Why Your Personal and Business Credit Are Suddenly Joined at the Hip

In the early days, you are the business. Banks and vendors know this. That means your personal credit score isn’t just for getting a car loan anymore—it’s your company’s financial first impression. Before you have years of revenue or assets, lenders will look at your personal history as a proxy for your business reliability.

Think of it like this: your personal credit is the training wheels. It helps you get initial lines of credit, business credit cards, or even a small equipment loan. The goal? To use those tools responsibly to build a separate, strong business credit profile. So step one is knowing your own numbers. Pull your reports. Understand your score. Clean up any errors. It’s a boring hour of work that pays off for years.

The Foundational Moves: Separating and Tracking

Okay, so you’ve checked your personal credit. Now what? The single most important piece of credit management for startups is separation. Mixing personal and business expenses is a recipe for accounting nightmares and tax-time headaches.

1. Get the Legal Structure Sorted

Form an LLC or corporation. This isn’t just about liability protection (though that’s huge). It formally establishes your business as a separate entity in the eyes of… well, everyone. It’s the first step to building business credit.

2. Open a Dedicated Business Bank Account

Use your formation documents to open a business checking account. All income and expenses should flow through here. Period. This clarity is everything.

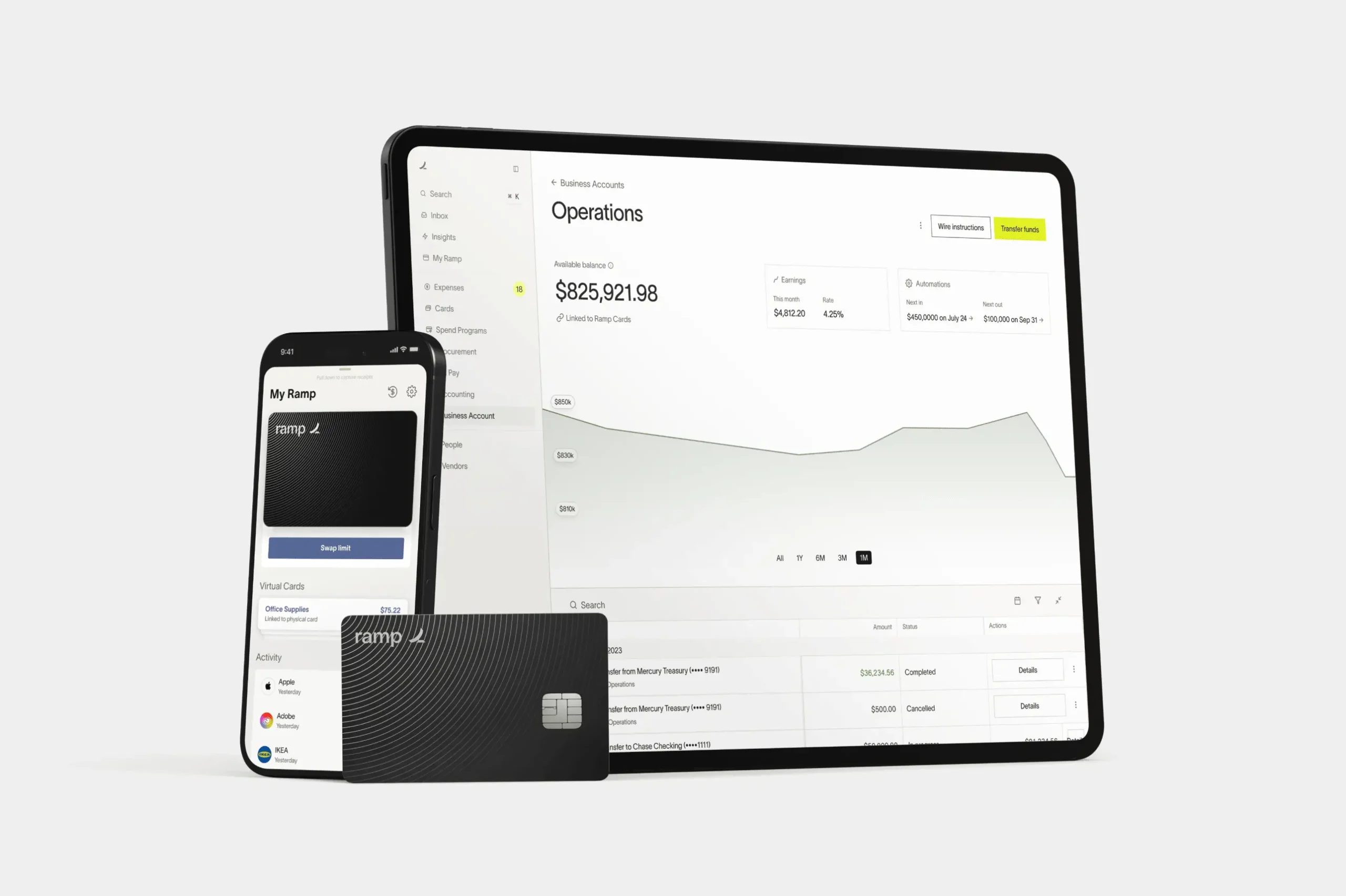

3. Apply for a Business Credit Card

Start with a card that reports to business credit bureaus (Dun & Bradstreet, Experian Business, Equifax Business). Use it for predictable, recurring expenses you’d pay anyway—like software subscriptions or cloud hosting. Then pay the balance in full, every single month. You’re not financing debt here; you’re building a track record.

Strategic Credit Use: Fuel, Not a Crutch

This is where mindset matters. For a self-funded entrepreneur, credit should be a strategic accelerant, not a way to fund a burn rate you can’t afford. It’s for smoothing cash flow gaps—like buying inventory for a confirmed order—or for essential capital expenditures that will directly generate revenue.

Avoid the trap of using credit to cover operational losses month after month. That’s a quick spiral. Instead, set hard rules for yourself. For instance, only use the credit line for expenses that have a clear ROI within 90 days.

Here’s a quick table on good vs. risky uses of credit in those early stages:

| Strategic Use (Fuel) | Risky Use (Crutch) |

| Bridging a 30-day gap between invoicing a client and getting paid. | Paying salaries when you have no signed contracts. |

| Buying bulk inventory at a discount for a peak sales season. | Funding a marketing experiment with no clear metrics or budget. |

| Covering the cost of a trade show where you have qualified leads. | Paying for office upgrades or non-essential perks. |

| Essential software or equipment that directly increases productivity. | Keeping the lights on while you “figure out” revenue. |

Monitoring and Scaling Your Business Credit

You’ve got accounts, you’re using them wisely. Now, you need to monitor. Business credit scores are opaque compared to personal ones. You’ll need to actively check with the major bureaus. Set a calendar reminder to review them quarterly.

As you grow, add “trade lines” with vendors. Net-30 accounts with your office supplier or web hosting company are a classic way to do this. You get the service or product now, pay the invoice in 30 days, and they report your good payment history. It’s like adding positive references to your credit resume.

The end goal? To decouple. A strong business credit profile means you can qualify for loans, larger lines of credit, and better terms based on your company’s merit—not your personal guarantee. That’s a major milestone for any founder.

The Pitfalls Everyone Talks About (And The Ones They Don’t)

Sure, everyone warns about high interest rates and overspending. But the real pitfalls for founders are subtler.

Personal Guarantees: You’ll likely have to sign them for years. Understand exactly what you’re pledging. It often means your house, your savings, everything. That risk should inform every credit decision.

The Utilization Ratio Ghost: Even with business cards, using too high a percentage of your available limit can ding your score. Try to keep usage under 30% when the statement cuts.

The “Easy Money” Distraction: A sudden line of credit can feel like validation. It can fund a side-quest that distracts from your core, revenue-generating work. Stay disciplined.

And a less-discussed point? Communication. If you hit a rough patch and might miss a payment, call the lender. Proactively. They’d often rather work out a plan than send you to collections. Silence is your enemy.

Wrapping It Up: Credit as a Foundational Skill

Look, building a startup is a series of calculated risks. Credit management is the practice of making those risks… well, more calculable. It’s not the most glamorous part of the journey. But getting it right gives you options. It gives you breathing room. It turns financial friction into a bit of grease for the wheels.

For the self-funded entrepreneur, financial leverage isn’t about debt—it’s about creating a stable platform from which to leap. Start clean, separate everything, use credit with surgical intent, and monitor like a hawk. Do that, and you’re not just building a product. You’re building a resilient company. And that, in the end, is what gets you to the next chapter.